LANDLORD NEWSLETTER

February 2023

It is a new year, new goals, and a new beginning! New beginnings bring challenges, opportunities, ideas, and experiences.

We hope everyone has had a productive start and is looking forward to a healthy and prosperous new year.

WELCOME OUR NEW LEASING COORDINATOR

Terry Del Giorgio

Terry is an enthusiastic professional that was seeking a new challenging career when joining 3G Properties Group. Terry received her BA in Liberal Studies from Cal Poly University after raising her three children. She has over twenty years of experience in the field of education. Terry is organized, self-motivated and a lifelong learner. She enjoys time with her grandchildren, acrylic painting, music, and a good cup of coffee.

Texas Housing Insight

Joshua Roberson and Weiling Yan (Jan 10, 2023)

The housing market continued to slow down as people considered mortgage rates and recession fears when making financial decisions. On the supply side, housing permits and housing starts are both in decline. Prices are correcting, and the market is accumulating inventory. However, as suggested by the sales volume, buyers are calmer now than during the pandemic frenzy, as many key indicators such as days on market (DOM) and months of inventory (MOI) are uniformly convergent back to pre-pandemic levels. With the expectation of a higher mortgage interest rates annual average in 2023, existing-home sales will likely fall short of 2022's levels.

Homebuilders are initiating fewer building projects. The state's year-to-date cumulative single-family construction permits in November 2022 had a net loss of 5.2 percent, shrinking from 157,043 to 148,954 units. The monthly drop paused in November, and construction permit issuance remained below 10,000 units. Construction permits rebounded in all major metros except Austin. Dallas (2,886 permits) gained more than 300 permits, while issuance in Houston (3,223 permits) stayed steady. Despite the slight decrease in Austin, the tech metro (1,341 permits) expanded residential space for single-family homes twice as fast as in San Antonio (663 permits). Construction generally slows during the winter, yet even after the seasonal adjustment, Texas' single-family construction starts plummeted 28.5 percent from 2021 to 10,700 units, corroborating a slowdown in the housing industry.

The number of homes for sale typically declines after the summer peak. However, active listings have been quickly accumulating to a seasonally adjusted level of 91,600 units. Compared with the five-year average of 94,800 units before the pandemic, this November's housing inventory level is only 4.5 percent away from rebounding back to the pre-pandemic volume, rather than 50 percent a year ago. Amid the rebound, Texas' MOI ticked up to 2.9 months. Austin's inventory level jumped to a ten-year high with 9,000 homes ready for sale, while Dallas's housing supply was tight with 20,000 homes for sale, 3,700 fewer than in November 2019.

Demand

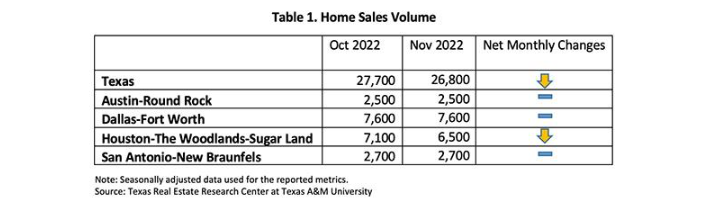

Total home sales inched down 3.3 percent month over month (MOM), settling at a seasonally adjusted rate of 26,800 closed sales (Table 1). Sales in Houston took a big hit, while sales in the other major metros stayed at October levels. Texas' sales volume has shrunk by one tenth compared with a year earlier. As winter approaches, sales are expected to trend downward for the next two months.

Rising mortgage rates affect sales of differently prices homes disproportionately. Up to November, total sales for homes priced below $300K plummeted close to 30 percent in 2022, while total sales grew 15 percent for homes priced between $400K and $500K. The sales disparity between these two groups could suggest that rising rates sidelined more homebuyers in the lower-middle class than upper-middle class.

Amid slowing sales, homes are sitting on the market longer. Texas' average DOM rose to 46 days. Compared with the five-year average of 59 days before 2020, the relatively brief period suggests the housing market is still relatively tight compared with historic norms. At the metropolitan level, Austin's DOM rose most aggressively, doubling from 27 days in June to 57 days in November. Dallas' DOM grew most moderately, rising from 25 to 42 days.

Before the pandemic, the state's DOM ranged from 55 days to 83 days. Now, DOM ranged from 45 days to 52 days. The relatively truncated DOM interval implies the housing market still has room to improve. Another metric that signals the housing market can be more relaxed is DOM for pricier homes. Typically, the most expensive homes sit on the market the longest. However, DOM for homes priced over $750K was 45 days—shorter than homes in the $500K price cohort.

Prices

Texas' median home price continued to fall, and the seasonally adjusted median price edged down 1 percent MOM. The four major metros posted mixed monthly changes (Table 2). Regardless of the depreciation in the past six months, the state's median price remained 6.1 percent higher than year-ago levels. Dallas had the highest growth of 9.6 percent, while Austin's growth rate deflated to 0.1 percent.

percent, while Austin's growth rate deflated to 0.1 percent.

Since the Federal Reserve imposed the first 75-basis-point interest rate hike in June in an attempt to curb inflation, the ten-year U.S. Treasury bond yield jumped 129 basis points to 3.89 percent2, while the two-year counterpart surged by 150 basis points. The spread between the ten- and two-year bond yields widened while staying in negative territory, indicating persistent market uncertainties.

The Federal Home Loan Mortgage Corporation's 30-year fixed-rate moderated slightly this month to 6.81 percent, but it still surpassed historical rates during 2007 and 2009. According to a Wall Street Journal analysis, some buyers have had to dodge the conventional way of borrowing from traditional lenders and instead borrow directly from family members or leverage either business or personal assets.

The Texas Repeat Sales Home Price Index accounts for compositional price effects and provides a better measure of changes in single-family home values. Compared with November 2021's 19.5 percent year-over-year (YOY) increase, Texas' index accelerated 9.2 percent YOY in November 2022, indicating price moderation. The same trend also affected the major metros as growth rates shrank from double-digits to single-digits, except in San Antonio, which was 12.8 percent. Moderating home prices corroborated with the Fed's inflation fight.

Household Pulse Survey

According to the U.S. Census Bureau's Household Pulse Survey, after last year’s historical low rates, the share of homeowners who were free from mortgage payments ticked up 3 percent to 36 percent in the U.S. and up 5 percent to 42 percent in Texas (Table 3). The share of homeowners who were caught up on payments increased as well.

1 All measurements are calculated using seasonally adjusted data, and percentage changes are calculated month over month, unless stated otherwise.

2 Bond and mortgage interest rates are non seasonally adjusted. Loan-to-value ratios, debt-to-income ratios, and the credit score component are also non seasonally adjusted.

5 Reasons This Isn’t a Repeat of the 2008 Housing Crash

December 15, 2022

NAR Chief Economist Lawrence Yun draws the distinctions between today’s real estate market and that of more than a decade ago.

Many homeowners are still haunted by the 2008 housing crash when property values collapsed and foreclosures spiked. The memory of sudden catastrophe at a time when the real estate market had been riding high may help explain why 41% of Americans say they now fear a housing crash in the next year, according to a new survey from LendingTree.

Are their fears well-founded?

“It’s a valid question,” Lawrence Yun, chief economist for the National Association of REALTORS®, said Tuesday at NAR’s Real Estate Forecast Summit. “People are remembering the crushing and painful foreclosure crisis. So, it has become a key question: Will home prices crash after the strong run-up in prices across the country over recent years?”

At the virtual conference, where leading housing economists offered their 2023 forecast for the real estate market, Yun offered assurance that current dynamics are nothing like during the Great Recession. He pointed to several key indicators of how this market differs.

The labor market remains strong. In the last major housing downturn, there were 8 million job losses in a single year. Now there are virtually none. Though layoffs in the technology and mortgage industries are occurring, they haven’t accumulated enough to form a net job loss, Yun noted. A strong job market bodes well for housing’s future.

Less risky loans. Yun also noted the subprime loans that were prevalent during the 2008 housing bust are basically nonexistent today.

Underbuilding and inventory shortages. New-home construction prior to the 2008 crash was amounting to 7.65 million units annually. Today, it’s 4.6 million. Yun points to “a massive housing shortage” from a decade of underproduction in the housing market.

Delinquency lows. About 10% of all mortgage borrowers were delinquent on their loans in the previous housing bust. The mortgage delinquency rate is now at 3.6%, holding at historical lows, Yun said.

Ultra-low foreclosure rates. Homes in foreclosure reached a rate of 4.6% during the last housing crash as homeowners who saw their property values plunge walked away from their loans. Today, the percentage of homes in foreclosure is 0.6%—also at historical lows, Yun said. He predicted foreclosures to remain at historical lows in 2023.

Overall, the fundamentals don’t point to a housing market that is operating similarly to the 2008 cycle, Yun said. While home sales are slowing, prices remain up nearly 6% as of October sales numbers compared to a year ago. Also, inventory remains low, which will keep home prices elevated, Yun said. “The chance of a price crash is very small due to the lack of supply.”

Local Market Statistics

December 2022

(January not available yet)

Please bear in mind 3G Properties Group handles basic maintenance requests and is not a general contractor or construction company. We are happy to work with YOUR preferred vendors as long as 3G obtains proof of their liability insurance, copy of their W9 and coordinates the repairs. As your property management company, we are charged with coordinating all maintenance with your resident as part of our liability protection for both you and 3G. If the owner, resident and vendor are communicating outside of our Maintenance Coordinator and/or 3G team, this can cause significant problems. We expect to pay your vendor through our system so all of your annual expenses are reflected on your 1099. 3G Properties Group strives to provide you with a “hands off” experience as much as possible, relieving you from maintenance burdens and headaches!

Due to the market conditions, we have experienced a churn in rental properties and are consistently onboarding properties across the Metroplex. More Landlords are seeing the value in real estate investing during these uncertain times. As the market has continually proven, real estate has traditionally been considered a sound investment, and savvy investors can enjoy a passive income, excellent returns, tax advantages, diversification, and the opportunity to build wealth.

As 3G continues to grow so is our team, systems, and processes. 3G is committed to high customer satisfaction and excellence. We take pride in creating lasting relationships with our clients. Our biggest job as your Professional Property Management Team is to protect YOUR asset and limit your liability exposure.

With 200+ properties in our management portfolio, we are confident our integrity, professionalism and expertise benefit you as the Landlord. Our Property Managers are licensed REALTORS® and experienced in handling tenant disputes and issues. Our 3G management team has a combined experience of over 80 years in real estate and are versed in real estate-related regulations.

Our 3G team has earned some prestigious awards last year and we take these seriously! We appreciate YOU, your tenants and your referrals.

Notes from a few of our residents and other landlords!

I have to tell you that we brag about your company. It's basically out of sight out of mind. We love it that way.

Kim and Kathryn - Landlord

“3G properties have been so great to work with! The renting process has gone so smooth with them and we have zero complaints. Looking forward to our continued relationship the next few years!”

Allison - Resident